how long does the irs have to collect back payroll taxes

IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due.

Awesome The Best Computer Science Resume Sample Collection Teacher Assistant Teacher Resume Examples Teacher Resume

However there are several things to note about this 10-year rule.

. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. Semi-weekly deposit schedules require employers to deposit taxes for Wednesday Thursday or Friday payments by the following Wednesday. Thus once an assessment occurs the IRS has 10 years to pursue legal action and collect on tax debt using the considerable resources at its disposal which include levies and wage garnishments.

This can happen in a number of ways. This three-year timeframe is called the assessment statute of limitations. After the IRS determines that additional taxes are due the.

Publication 1854 How to Prepare a Collection Information Statement Form 433-A PDF. Owe IRS 10K-110K Back Taxes Check Eligibility. See if you Qualify for IRS Fresh Start Request Online.

If you are looking for the statute of limitations on tax debt it is safe to assume that you did not pay your tax bill when. Understanding collection actions 4 Collection actions in detail5. Form 433-B Collection Information Statement for Businesses PDF.

If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4. This is the length of time it has to pursue any tax payments that have not been made. A tax assessment determines how much you owe.

There is an IRS statute of limitations on collecting taxes. With monthly deposits payroll taxes for one month must be provided by the 15th of the following month. 1200 after tax breaks down into 10000 monthly 2300 weekly 460 daily 058 hourly NET salary if youre working 40 hours per week.

Ad Owe back tax 10K-200K. Used to secure information7 IRS Actions Affecting Passports7. How Long Does the IRS Have to Collect Taxes.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. Ad File Settle Back Taxes. The IRS 10 year statute of limitations starts on the day that your tax return was processed.

Form 433-F Collection Information Statement PDF. Possibly Settle Taxes up to 95 Less. The collection statute expiration ends the governments right to pursue collection of a liability.

The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. IRS back taxes are collected thru a brutal program known as the IRS Collection Process - wage garnishments bank levies and tax liens. If you did not file a tax return the IRS will create a return and file deficiency assessment which will begin the ten-year statute of limitations.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The IRS has a set collection period of 10 years. The 10-year deadline for collecting outstanding debt is measured from the day a tax liability has been finalized.

If the IRS shows up after that you may. How far back can the IRS collect unpaid taxes. First the legal answer is in the tax law.

This time restriction is most commonly known as the statute of limitations. When does the IRS statute of limitations period begin. What is 1200 after taxes.

Up to 25 cash back As a general rule there is a ten year statute of limitations on IRS collections. IRS back taxes are collected by the IRS through a formal program known as the IRS Collection Process. After this 10-year period or statute of limitations has expired the IRS can no longer try and collect on an IRS balance due.

You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. This is called the IRS Statute of Limitations SOL on collections. Take Advantage of Fresh Start Program.

Trusted A BBB Member. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Subject to some important exceptions once the ten years are up the IRS has to stop its collection efforts.

Deposits for Saturday Sunday Monday or Tuesday payments must be made by the following Friday. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Get Your Qualification Options for Free.

1200 after tax is 1200 NET salary annually based on 2022 tax year calculation. A seizure of property6 Summons. Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed your return or April 15 whichever is later to charge you or assess additional taxes.

In other words the IRS has 10 years from the date of assessment to collect back taxes. If you dont pay on time. The IRS 10 year window to collect starts when the IRS originally determines that you owe taxes that is usually when you filed your tax return or when the result of an IRS audit.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. Federal Tax Lien5 Notice of Federal Tax Lien5 Levy. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF.

Fillable Form 1040x 2017 Health Care Coverage Lesson Tax Forms

કરપરશન મલકત વરન રબટ યજનન મદદત બ મહન વધરશ ગધનગર ત 22 મ 2020 શકરવર ગધનગર મહનગરપલકન નણકય વરષ ર મટ ત એપરલથ ત મ સધ Property Tax Irs Taxes Problem And Solution

Tax Cartoons By Jeff Swenson Accounting Humor Taxes Humor Tax Season Humor

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Credit Card Statement Tax Forms

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

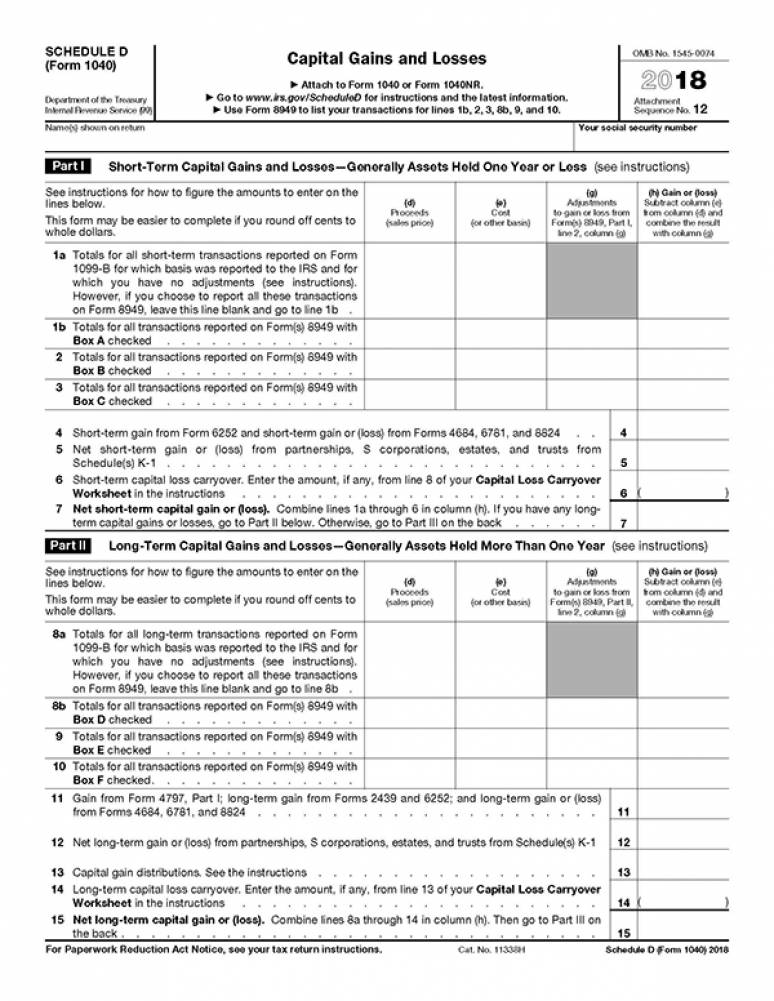

Google Image Result For Https Bookstore Gpo Gov Sites Default Files Styles Product Page Image Public Covers F1040sd Tax Forms Capital Gains Tax Irs Tax Forms

Tax Cartoons Taxes Humor Accounting Humor Tax Season Humor

Yes They Do Taxes Humor Accounting Humor Funny Quotes

Irs Installment Agreement Franklin Park Il 60131 Mm Financial Consulting Inc Irs Taxes Payroll Taxes Internal Revenue Service

Irs Partial Payment Installment Agreement Texas M Financial Consulting Inc Financial Blog Cleburne